What happened? Let’s start with defined pensions. Before the 1960s, employers were encouraged by Federal Government Tax Policy to offer pension plans. Initially, these plans were funded by the purchase of group annuities guaranteed by insurance companies. During the 1950s, many employers found they could get greater returns in the equity markets than what insurance companies were able to give them. They formed Pension Trusts to hold the invested assets behind the retirement promises they made.

The Government Tax Policy allowed such employers to deduct from their corporate taxes contributions made to Pension Trusts. It was only rational to fund those pensions as a level percentage of payroll over the working careers of the employees and the IRS supported such rational funding. Recognizing the long-term nature of the funding, it was common to spread investment gains and losses, and changes in liabilities due to shifts in employee demographics, over the careers of the covered employees.

A popular method was the Frozen Initial Liability method. The “level” annual cost for the plan was calculated as thought he plan had been in effect for the full careers of the employees, but that left an “initial liability” representing the funds that would have accumulated if the plan had always been there. That amount was then “frozen” and treated as a liability to be amortize by payments over a period of years. The IRS ruled that no more than 10% of the Frozen Initial Liability could be deducted in any year. This level funding method worked well for employers and defined benefit pension plans continued to be popular as they had been during the World War II years when pensions were offered to attract workers in a time of labor scarcity.

That changed in the 1980s as the IRS shifted policy to reduce most current liability deductibility and to require that assets be valued at current market values (See Social Security Administration Explanation by clicking on this sentence). The latter requirement introduced volatility into pension funding since deductible pension funding contributions were curtailed when stock markets were strong leaving pension plans underfunded when markets fell.

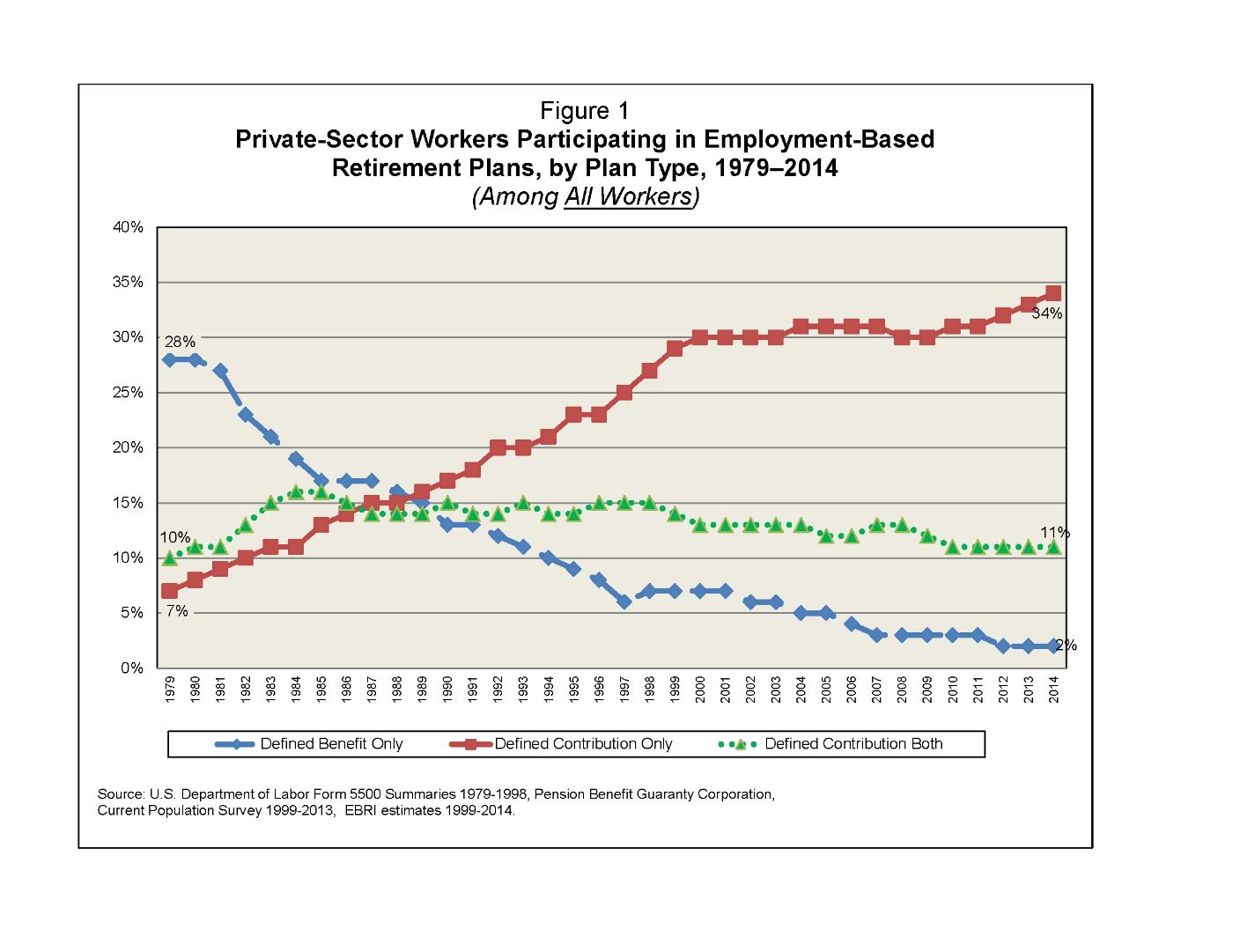

That change led employers to shift from defined benefits to contribution plans like 401(k) and 403(b) programs, leaving it up the employees to plan for their retirement income needs. It’s that change in IRS policy that has put today’s retirees at greater risk than were those of an earlier era. While we might expect that the enforcement role of the IRS would be the fair implementation of the tax laws – equally concerned with overpayments of taxes as with underpayments – in practice the IRS often acts as though its mission were to maximize tax payments.